After showing yourself how new forms of acquisition are further shuffling perceptions of car sales by channel and the importance that financing has for the purchase of cars in Portugal, this text reveals the weight that the used car trade has on the sector's activity.

In fact, due to the volume and dynamics of both large operators and small traders, the used car market was once again the main driver of motor vehicle trade in Portugal and of financial activity linked to the sector.

All types of car financing grew for the purchase of used cars, which can be referred to as "km 0", as well as imported used cars (which grew 16.7% in 2018 and accounted for 34% of the volume of new cars), such as those arising from repossessions, which often enter the parallel market and are sold by unregistered operators.

This last type of commerce assumes great relevance in a market where the lack of a feasible policy to encourage the scrapping of end-of-life vehicles is increasing the average age of the car fleet in Portugal.

Subscribe to our newsletter

Vehicles over 15/20 years old purchased for a few thousand euros, often using credit card cash advances, some of which reach this market or are sold by – or in association with – sellers of some concessions, which they enter as returns.

Pay attention to the following figures and tables to understand the scale of the reality of the car fleet in Portugal at the end of 2018:

NEW CARS MARKET PORTUGAL

- 228 290 Light passengers (+ 2.8%)

- 39 306 Light commercials (+ 2%)

IMPORTED USED MARKET

- 77 241 Light passengers (+16.7%; 33.83% of the new vehicle market)

- 3342 Light commercials (+ 53.6%; 8.5% of the new vehicle market)

TOTAL CAR REGISTRATION PORTUGAL

- 2 948 506 Light vehicles, motorcycles and heavy vehicles (online + in-person registration of new and used models)

UNITS IN CIRCULATION

- 5,015 000 Light passengers (4.8 million in 2017)

- 1 120 000 light commercials (1.1 million in 2017)

MIDDLE AGE OF THE CAR PARK

- 12.6 light passenger years (equal to 2017)

- 13.8 years of light commercials (13.7 years in 2017)

AVERAGE AGE OF VEHICLES DELIVERED FOR SLAUGHTER IN THE VALORCAR NETWORK

- 21.6 years (21.4 years in 2017, 20.7 years in 2016, 20 years in 2015, 19.7 years in 2014... 15.6 years in 2016)

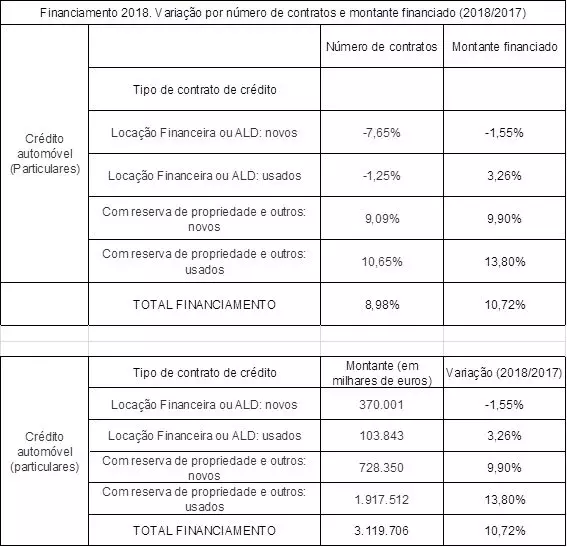

Finally, the following table results from the data obtained by Banco de Portugal and reflects only the amounts recorded for private customers. The values show the increase in the financing of used vehicles and even with reservation of title (new and used)

Consult Fleet Magazine for more articles on the automotive market.