The 2011 and 2020 decade was not especially easy for the car industry. After all, over the past 10 years, the automotive world has faced some of the greatest challenges in its history.

From recovering from a global financial crisis, to tightening anti-pollution regulations, to an emissions scandal, the decade appears to have culminated in the widespread announcement of mega-investments to tackle the electrification and digitization of the automobile.

To face all this, many car manufacturers and groups decided to follow to the letter the maxim “unity is strength”. Far from being a novelty in the automobile industry, partnerships, alliances and even mergers between manufacturers have accelerated again in the past decade, practically leading to the end of “proudly alone” brands.

Another of the novelties was the strong entry into the international scene of Chinese car manufacturers and groups, who went from outsiders at the beginning of the decade to leading actors, associating (and financing) prestigious European brands, taking the opportunity to, in this way, enter a market that was closing its doors to them.

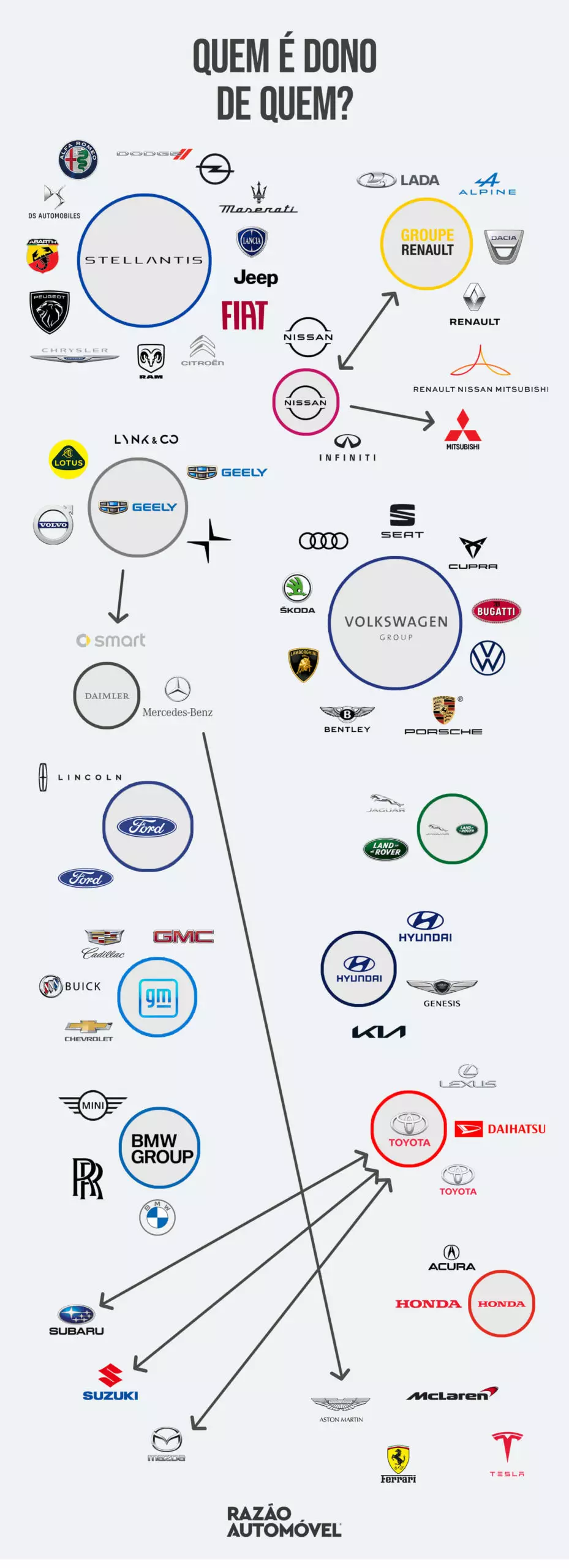

the owners of it all

Starting precisely in the Middle Kingdom, there is an automobile group that has stood out in the last decade: Geely (Zhejiang Geely Holding Group Co., Ltd). With 34 years of existence, this car industry giant is known for having emerged as Volvo's lifeline in 2010, at a time when the Swedish manufacturer was leaving Ford's sphere of influence.

Subscribe to our newsletter

Since then, Volvo has completely reinvented itself and has continued to grow, regaining prestige, sales and profit. Geely wouldn't stop here. It launched two brands in Europe — Lynk & Co in 2016 and Polestar in 2017 —, it also bought Lotus, which will (also) strongly bet on electrification, and even got a stake in Daimler (the parent company of Mercedes-Benz and Smart). It doesn't seem to us that they stop here...

Still not leaving the Chinese influence on the fate of European car groups, we have Dongfeng, which ended up playing a decisive role in the rescue of the French from Groupe PSA. The 2008 financial crisis put the French group in serious trouble at the beginning of the decade, but Dongfeng — a group with which Groupe PSA already had an established joint venture in China — together with the French state managed to successfully rescue the group.

Placing Carlos Tavares at the head of the French group was also a key element in making Groupe PSA one of the most vibrant car groups in recent years, returning not only to profits, but also to achieving the financial health that is possible. sort of very robust. To the point of having added another brand to the existing ones (Opel) and having made another autonomous (DS Automobiles).

Speaking of Opel, he was one of the protagonists of the “storm” at GM (General Motors) after the financial crisis. After a first attempt to sell it in the aftermath of the crisis — avoiding the same demise of historic names like Saab or Pontiac — it would eventually be sold (like its “twin”, Vauxhall) to Groupe PSA in 2017. Since then, the German brand has managed to return to profits — in 2018 — something that hasn't happened since… 1999!

The former “owner of it all” (it was for a long time the biggest automobile group on the planet), GM, on the other hand, has not stopped post-crisis shrinking its presence on the planet. It got rid of several brands, left several markets and ended its industrial operations in several countries.

He said a (almost) definitive “farewell” to Europe — he sold Opel and Chevrolet left the “Old Continent” in 2016 —, focused on its most profitable markets, such as North America, and consolidated its presence in the “ El Dorado” which is the Chinese market, much through Buick.

The Renault-Nissan Alliance also became the Renault-Nissan-Mitsubishi Alliance as of 2016, after the acquisition by Nissan of 34% of Mitsubishi's capital in 2016, becoming the majority shareholder.

But perhaps the biggest highlight of the past decade has to be the merger between Groupe PSA and FCA (Fiat Chrysler Automobiles) announced in 2019 and formally terminated in early 2021 that gave rise to a new automobile giant: Stellantis.

The case of FCA is curious. After the acquisition of the bankrupt Chrysler in 2009, the new entity would be formed in 2014 with the merger of Fiat Group and Chrysler. However, it was not enough. Led by Sergio Marchionne (now deceased), it was one of the first to publicly acknowledge that, in the future, the industry could only overcome all challenges with more consolidation.

For years Marchionne looked for a partner to reduce costs and increase synergies. This search led FCA to "date" General Motors and Hyundai, and came close to tying the knot with Renault. Perhaps the main point of attraction for any group to join the FCA was the grand entrance into the North American market and access to the very profitable Jeep and Ram. Who knew that, after all these laps, they would join the French group?

As for the Volkswagen Group, one of the world's largest automobile groups, it had a troubled decade marked, above all, by Dieselgate, and a consequent tremendous investment in electrification. However, in parallel, it was not an impediment for the German giant to continue to increase its portfolio of brands. In 2012 it added Ducati, MAN and Porsche.

Friends, what do I want you for?

To consolidate operations (reducing costs and increasing economies of scale), acquisitions and mergers are perhaps the best way to achieve them. But that does not mean that it is the only way: partnerships for more specific areas have become even more common (and important) in the last decade. Everything to face the rising costs of development and production.

Perhaps the best proof of the importance of partnerships is given by Daimler. For many years “proudly alone”, between 2011 and 2020 the German brand worked more than ever together with other manufacturers.

The best known of these partnerships was with the Renault-Nissan Alliance. Not only did it wake up using the famous 1.5 dCi and 1.6 dCi (Class A, CLA, Class C), it even developed together with the Alliance (Mitsubishi wasn't there yet) the 1.33 Turbo gasoline engine.

But there's more: Daimler developed the current generation of Smart fortwo/forfour and Renault Twingo “in half” with Renault and took advantage of the know-how of the French brand in the area of small commercials to create the Mercedes-Benz Citan, a version Germanized from Kangoo. The Renault-Nissan Alliance took advantage of the A-Class MFA platform to launch the Infiniti Q30 and QX30 (unfortunately they were not successful and their careers ended).

Also noteworthy is the proximity to Aston Martin by Daimler. First with the supply of engines (V8) and electronic components, and recently with the acquisition of part of the British manufacturer.

In the field of technology, Daimler has also embraced the maxim that “unity is strength” (and cuts costs), having, for example, acquired Nokia's HERE application with rivals BMW and Audi. Still with BMW, Daimler merged its company Car2Go with Share Now — car sharing companies — creating Drive Now. The two “enemies” are still together in the development of technologies for autonomous driving.

Also talking about BMW, the company decided to join forces with Toyota and together they developed not only two sport models — BMW Z4 and Toyota GR Supra — but also collaborate in other areas that you will see later.

Not leaving the sports theme, there was even more that resulted from the collaboration between two manufacturers: Mazda MX-5/Fiat 124 Spider/Abarth 124 Spider and Toyota GT86/Subaru BRZ.

Electrify the car? it is necessary to unite

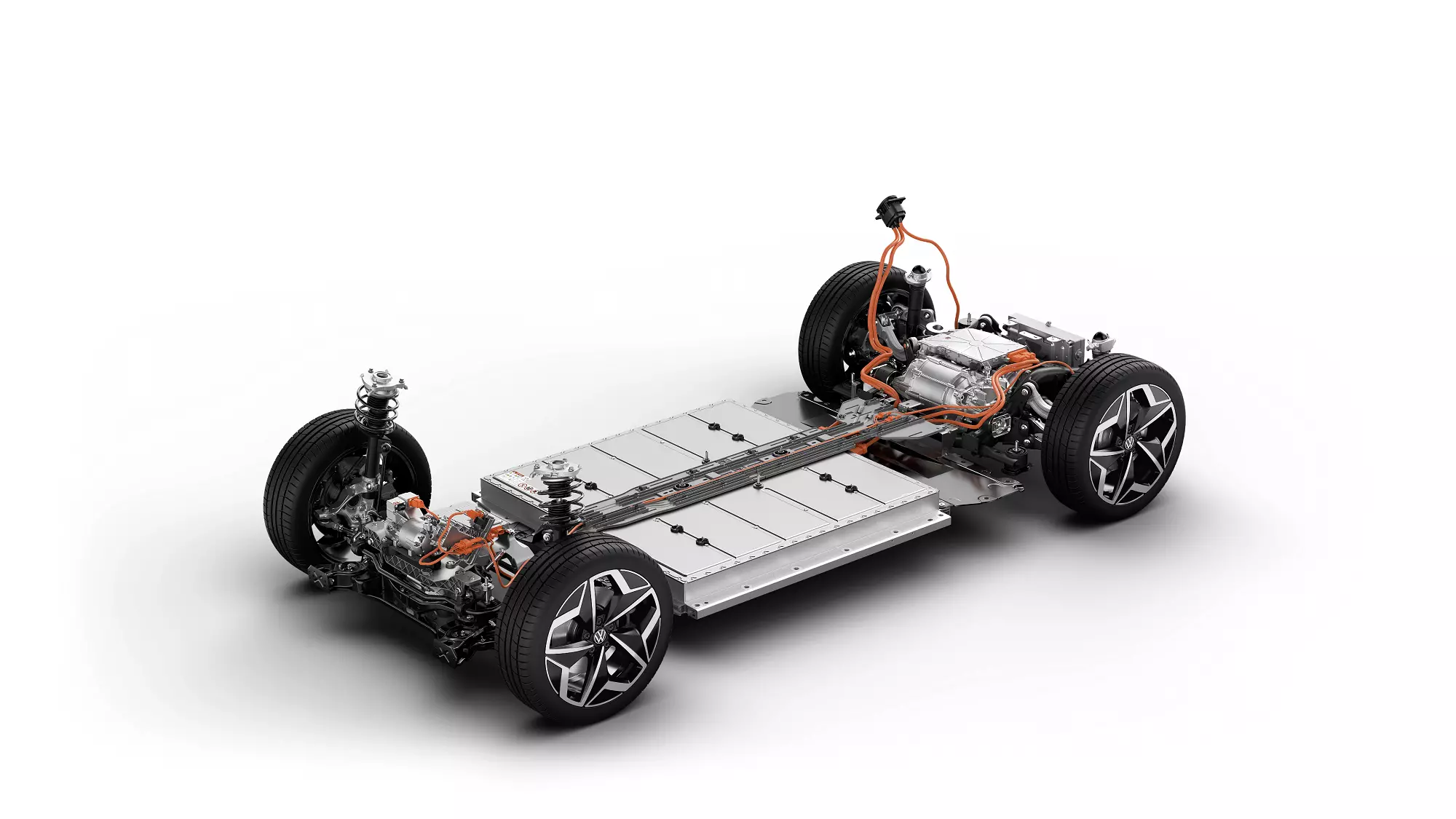

Much has been said about the rapid transformation the car industry is undergoing. A large part of this transformation involves the partial and total electrification of the automobile, a transformation that entails very high costs. It is not only necessary to acquire new skills and develop new technologies, but also to adapt the existing industrial structure and create a new one (battery factories, for example).

The large investments needed will only pay off if there are high economies of scale, but not everyone in the industry has them and therefore new partnerships were made in this regard, either to share the development costs or to supply the technology.

Ford and Volkswagen, despite being two car giants, “held hands”… again. After having produced the Ford Galaxy/Volkswagen Sharan/SEAT Alhambra together in Palmela, this time Volkswagen will hand over the famous platform for electric models MEB to Ford.

They are not the only ones. Honda, one of the few builders “proudly” alone, established, in 2020, a partnership with General Motors, to jointly develop electric models of the Japanese brand equipped with Ultium batteries of the American giant.

At the same time, the Japanese Mazda, Toyota and Denso “joined hands” and together created a new company three years ago. The purpose of this joint venture? Develop basic structural technologies for electric vehicles. Also at Toyota, its increasingly intricate relationship with Subaru also involves the development of electric vehicles.

Daimler, too, has partnered with Geely to develop and produce in China the next generation of Smart's small models, which will continue to be exclusively electric.

Car electrification is not only done from electric to batteries. Fuel cell (hydrogen fuel cell) technology is more distant in time, but seems to be starting to gain momentum, especially when associated with heavy goods vehicles. Volvo and Daimler have joined forces in this direction, for example, for their future trucks.

As far as automobiles are concerned, perhaps it won't happen that quickly, but there are several partnerships already established in the industry regarding hydrogen fuel cell technology: again BMW and Toyota, and also between the Hyundai Motor Group and Audi.

Finally, automobile electrification would not be complete without hybrids. Once again, Toyota assumes a prominent role here, having established several partnerships to supply its technology and/or models. One of them was with Suzuki, having resulted in the launch of two models, the Swace and the Across. A “good old example” of badge engineering that allowed Suzuki to have two hybrid models in Europe without the high development costs associated with this technology.

The Suzuki Swace is based on the Toyota Corolla…

Mazda also uses Toyota's hybrid technology, applying it to models like the Mazda3, but whose marketing is limited to some markets such as the Japanese. The collaboration between Mazda and Toyota extends into more areas: from the construction of a common factory in the US to the launch of a version of the Yaris Hybrid in Europe by Mazda.

It's easier to work together

And if in the world of passenger cars, partnerships and joint ventures are increasingly common, in commercial vehicles (FCA-PSA, for example, or between Volkswagen-Daimler) it is normal and in the past decade it was no different.

Thus, in search of lost success in the light goods segment, Toyota teamed up with Stellantis (then still PSA) to produce the Toyota ProAce and ProAce City. The first came to take the place of Hiace, while the second, starting from the base of the Citroën Berlingo, Peugeot Partner and Opel Combo, took Toyota to a segment where it had never been.

ProAce City marked Toyota's debut among the smallest commercials.

As for Mercedes-Benz, it took advantage of partnerships with the Renault-Nissan-Mitsubishi Alliance and in addition to having launched the Citan (based on Kangoo) it made its first pick-up known to the world, the X-Class. “cousin” of the also unprecedented Renault Alaskan, the Mercedes-Benz X-Class is proof that “as a team” it is easier (and cheaper) to reach new segments.

Finally, also in the field of commercials, Ford and Volkswagen will cooperate. In this way, the successor of Ford Ranger will give rise to the second generation of… Volkswagen Amarok. The successor to Ford Transit Connect, the smallest of the Transit, will derive directly from the new Volkswagen Caddy. The next generation of Volkswagen Transporter will be developed by Ford, that is, Transporter will be “sister” of Ford Transit.

Another partnership in pick-up trucks that ended up having little commercial effect was that between Fiat and Mitsubishi, with the first to market Fullback, a “clone” of the well-known L200.

Ferrari: proudly alone

Interestingly, in a decade marked by mergers and unions, there was a brand that followed the opposite path and is, for the moment, alone, a little like its founder: Ferrari.

After 45 years under Fiat's "hat", the first signs of separation emerged in 2014, with Sergio Marchionne seeing an opportunity to grow the value of the historic Italian brand and also help finance the recovery of other brands in the group, namely to Alfa Romeo. Ferrari's separation process from the FCA began in 2015 and on January 3, 2016 was declared complete.

The operation proved to be a… success and nowadays Ferrari, alone, saw its valuation almost fivefold, being worth practically as much as the whole of Stellantis, for example.

growing pains

Not everything was “roses”. There were also several problems in many of these partnerships and unions, or simply, they no longer make sense.

Perhaps the most talked about in recent years has been the Renault-Nissan-Mitsubishi Alliance, whose relationship problems simmered in the media in 2018, after the arrest of its leader, Carlos Ghosn. However, the news of the “death” of the alliance was manifestly exaggerated. After a more turbulent period, the three brands arrived at a new model of cooperation, as only together will they be able to face this entire period of change.

Still involving the Renault-Nissan-Mitsubishi Alliance, we have recently also seen a palpable gap with Daimler. Mercedes-Benz, for example, stopped using Renault's 1.5 dCi in 2020. At the same time, the new global partnership (50-50 joint venture) between Daimler AG and Geely to operate and develop Smart globally dictated the end of the partnership with Renault that resulted in the current generation of Smart Fortwo/Forfour and Renault Twingo.

the next decade

Now at the “door” of a new decade, more than mergers and partnerships, as we saw in the past decade, there is an even more pressing question on the horizon of the automotive industry: who will be the survivors until the end of this new decade?Carlos Tavares warned of the risk of the rapid and very expensive transformation that the automobile industry is undergoing. There is a possibility that, according to him, not everyone will be able to survive until the end of the next decade, especially when dealing with a market that is still falling, due to the pandemic crisis with the consequent economic crisis that is marking the beginning of decade. Nor will acquisitions, mergers and partnerships be enough to consolidate the entire industry.

Who owns who?

We finish off with an infographic that shows the “state of things” at the end of the decade that ended. How much will it change in 10 years?