Along with other threats, fiscal unpredictability is one of the main problems facing the Portuguese economy. It becomes impossible to make decisions or plan investments. The recent episode of the abrupt end of tax incentives for hybrid vehicles is proof of this.

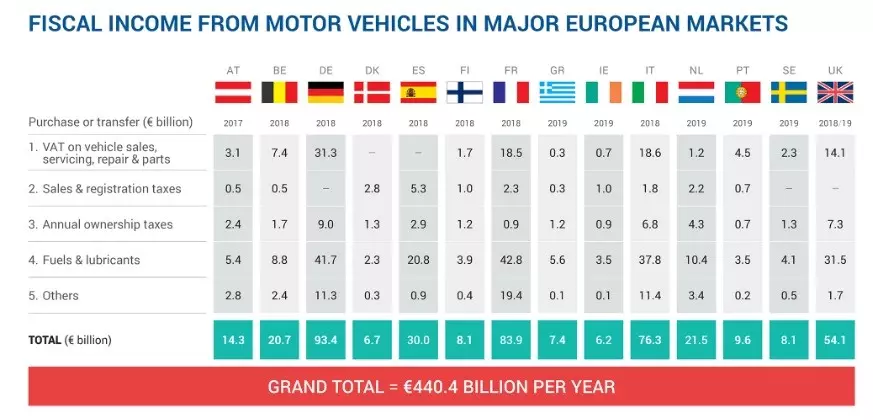

The entire industry was taken by surprise. Mainly ACAP, which, year after year, has shown a very limited capacity to make claims given the size of the sector it represents — the automotive sector in Portugal is responsible for 21% of tax revenue and for more than 150 thousand jobs.

At a time when the external context is of enormous uncertainty and demand — to the global pandemic situation we must add demanding environmental standards — it would be expected that, at least, at national level, it would generate confidence in economic agents, providing them with a legislative and fiscal framework predictable over a multi-year horizon, was a concern at the top of the political agenda.

Unfortunately, as has been seen, this is not the case. And in an equation where the country loses out, it doesn't matter if it was the political power that didn't listen, or if it was the automobile sector that didn't make itself heard. Or maybe both possibilities.

We have 2021 to prepare 2022 (and beyond)

In 2020, there was nothing to suggest the end of tax incentives for “environmentally friendly” cars. An end that translated, in some cases, into a double tax increase, calling into question the decisions of thousands of companies that opted for vehicles with hybrid and plug-in hybrid technology.

Subscribe to our newsletter

Therefore, if tax revenue takes precedence over environmental concerns, the following question arises: what will happen in terms of tax policy when 100% electric vehicles represent an even more significant share of the automobile market?

As we can see in this table, the Portuguese tax revenue is very dependent on the automobile sector. Given the pressure of public finances, is it expected that what happened to hybrids in 2021 could happen to electric ones in 2022?

The unpredictability of OE 2021 invites us to believe that nothing is impossible in this matter.

That's why the automotive sector and political power have to start preparing 2022 now. More than that, they have to prepare the next 10 years. The challenges that the automotive sector has to overcome by 2030 — which cut across society — demand it. It's either this or the general embarrassment.

The lack of communication that happened last November cannot happen again in future November. We will be watching for signs of ACAP and political power. Everything we can do in this direction will be little. The economy thanks and the environment too.