Put on your best suit… let's head to Wall Street to better understand why Tesla is already worth more money than Ford.

Tesla's share value continues to break records. This week Elon Musk's company passed the 50 billion dollar mark for the first time – the equivalent of 47 billion euros (plus a million minus a million…).According to Bloomberg, this valuation is related to the presentation of results for the first quarter of the year. Tesla sold about 25,000 cars, a number above analysts' best estimates.

Good results, party on Wall Street

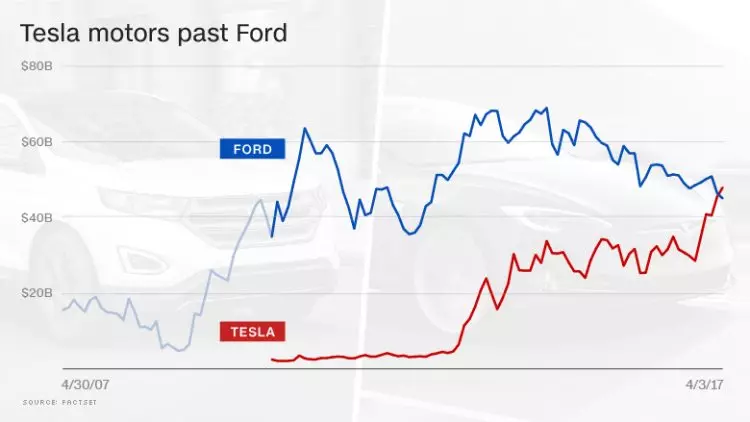

Thanks to this performance, the company founded by Elon Musk – a kind of real-life Tony Stark without the Iron Man suit – stood for the first time in history, ahead of the American giant Ford Motor Company on the stock market in fence. $3 billion (€2.8 million).

According to Bloomberg, stock market value is just one of the metrics used to calculate a company's value. However, for investors, it is one of the most important metrics, because it reflects how much the market is willing to pay for the shares of a particular company.

Let's go to the numbers?

Put yourself in the shoes of an investor. Where did you put your money?

On one side we have Ford. The brand led by Mark Fields sold 6.7 million cars in 2016 and ended the year with a profit of 26 billion euros . On the other side is Tesla. The brand founded by Elon Musk sold only 80,000 cars in 2016 and posted a loss of 2.3 billion euros.

THE Ford earned 151.8 billion euros while the Tesla earned just seven billion – an amount that, as we have already seen, was not enough to cover the company's expenses.

Given this scenario, the stock market prefers to invest in Tesla. Is everything crazy? If we only consider these values, yes. But, as we wrote above, the market is governed by several metrics and variables. So let's talk about the future…

It’s all about expectations

More than Tesla's current value, this stock market record reflects the growth expectations investors place on the company led by Elon Musk.In other words, the market believes that the best of Tesla is yet to come, and therefore, despite the current numbers being little (or nothing…) encouraging, there are expectations that in the future Tesla will be worth much more. The Tesla Model 3 is one of the engines of this belief.

With this new model, Tesla hopes to soar its sales to record values and finally reach operating profits.

“Will the Model 3 sell a lot? So let me buy Tesla shares before they start to appreciate!” In a simplistic way, this is the investors' perspective. Speculate about the future.

Another reason that makes the market believe in Tesla's potential is the fact that the brand is invest in its own autonomous driving software and in-house battery production. And as we are well aware, the general expectation of the automobile industry is that in the future, autonomous driving and 100% electric cars will be the rule rather than the exception.

On the other side we have Ford, as we could have any other manufacturer in the world. Despite the good performance of the car industry giants today, investors have some reservations about the ability of these "giants" to adapt to the changes that lie ahead. The future will tell who is right.

One thing is right. Anyone who invested in Tesla last week is already making money this week. It remains to be seen whether in the medium/long term this upward trend continues – here are some legitimate questions raised by Reason Automobile a few months ago.