We return to the theme of autonomous taxation, a recurrent theme and about which there are still countless questions. Autonomous taxation is nothing more than additional taxation applied to companies, when there are certain types of expenses (the most common example is expenses with vehicles).

The effects of the coronavirus pandemic naturally begin to show up in the companies' results in a negative way. As can be expected, due to the impact of COVID-19, this year will be synonymous with negative results in many companies.

So, it is urgent to identify ways to mitigate this impact , which will certainly involve the company's fiscal optimization.

Now, regarding Autonomous Taxation, the law provides for a 10 percentage point increase in the tax rate , if the company presents a negative result in a given year.

So, but the company has losses and the State charges more tax?!

In fact, that's right. It may not seem fair and reasonable, but it has happened. However, as a result of the current pandemic, this year we have a relevant innovation in this field…

Subscribe to our newsletter

Well, in 2020 it is expected that, for companies that present losses this year and that simultaneously have achieved positive results in previous years, they may have that aggravation cancelled.

This will be one more measure to ease companies from the tax burden that this year, in particular, is very heavy.

Let us remember that this type of additional taxation is levied on some company expenses, which the State considers in some way ambiguous in its assessment. Take, for example, car expenses and representation expenses.

Practical case: 1500 euros tax savings

Alberto is the manager of the company “Magnifico Empresário, Lda.”. The company has registered profits over the last few years of activity. However, as a result of the pandemic, it was forced to temporarily close doors.

For the company, the last few months were quite complicated and Alberto predicts that the coming months will be equally negative.

He does not consider closing his company, but admits that without the contractual agreement of a project that was in sight, in 2020 his company will have a negative result.

Alberto is now focused on finding out about the support and benefits that he will be able to enjoy, in order to reduce the effects of the respective taxes.

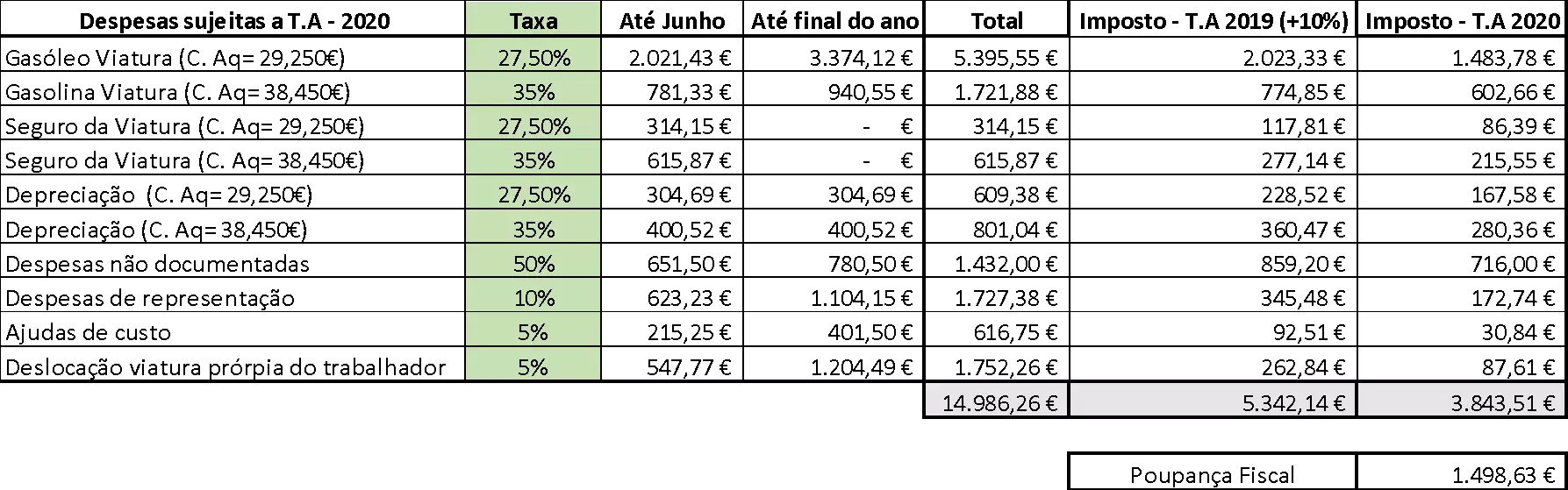

UWU Solutions illustrated and compared the scenario of probable expenses susceptible to Autonomous Taxation in 2020, with the situation prevailing last year.

The tax savings inherent to the relief granted for 2020 is real and will amount to around 1500 euros in “Magnifico Empresário, Lda.”.

This tax savings is due only to the correct framing, allowing Alberto's company to obtain very significant savings.

Article available at UWU.

Car Taxation. Every month, here at Razão Automóvel, there is an article by UWU Solutions on automobile taxation. The news, the changes, the main issues and all the news around this theme.

UWU Solutions started its activity in January 2003, as a company providing Accounting services. Over these more than 15 years of existence, it has been experiencing sustained growth, based on the high quality of services provided and customer satisfaction, which has allowed the development of other skills, namely in the areas of Consulting and Human Resources in a Business Process logic. Outsourcing (BPO).

Currently, the UWU has 16 employees at its service, spread across offices in Lisbon, Caldas da Rainha, Rio Maior and Antwerp (Belgium).