After learning about the social and tax benefits associated with the acquisition of electric vehicles and plug-in, Silvia, manager of the company “Hipóteses Fiscais, Lda.”, decided to purchase an electric car for her company.

With a view to the future, her goal is to replace the current diesel vehicle with a more environmentally friendly one!

Silvia acquired the current passenger car for 50,000 euros, in January 2015. Currently, and after some market research, it has realized that it can be sold for 25,000 euros.

Considering that the current vehicle has, for tax purposes, a useful life of 4 years, Silvia contacted UWU Solutions to clarify your questions and optimize this transaction.

This sale resulted in a potential tax payable of 5250 euros. However, with the support of the UWU, Silvia's company will pay half of this tax.

Let's see the impact of this sale on the results of “Hipóteses Fiscais, Lda.”!

What is the impact of this sale on the company's results?

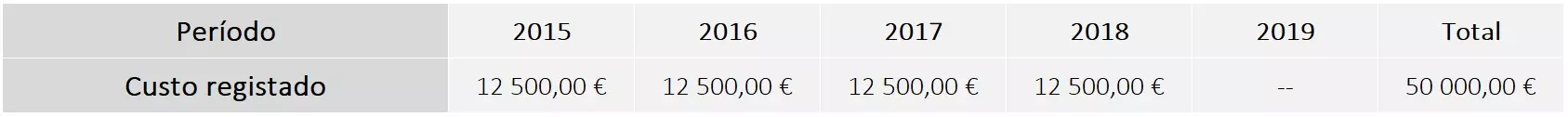

With the purchase of your diesel vehicle, we recorded a cost of 50,000 euros, over the life of the asset, ie:

The vehicle is fully depreciated in 2019, that is, it no longer has book value for the company. But, in the annual tax return of “Hípóteses Fiscais, Lda.”, it will only be considered as a cost of 25 000 euros because, the maximum annual limit accepted for tax purposes is 6250 euros.

Therefore, with the sale of the vehicle, Silvia assumes that there is a capital gain exactly equal to the sale value, that is, 25 000 euros.

Subscribe to our newsletter

Since the company did not deduct the total value of the vehicle in its annual declaration, the question that Silvia raises is:

- So will this profit pay IRC?

The answer is directly related to the purchase price of each light passenger vehicle...

When Sílvia decided to sell her company's vehicle, it was written off at 50,000 euros. But, for tax purposes, only €25,000 was considered to be a cost.

Therefore, if the vehicle is sold for 25 000 euros, there is a tax gain and, consequently, 5250 euros of tax to pay!

However, UWU Solutions found a way of "Fiscal Hypothesis, Ltd." pay only half that amount!

Like Silvia, many people are unaware of this situation and, as a result, pay tax on the sale of vehicles in the company.

If you are in a situation similar to this one, and you have doubts about selling your vehicle, contact us!

Article available at UWU.

Car Taxation. Every month, here at Razão Automóvel, there is an article by UWU Solutions on automobile taxation. The news, the changes, the main issues and all the news around this theme.

UWU Solutions started its activity in January 2003, as a company providing Accounting services. Over these more than 15 years of existence, it has been experiencing sustained growth, based on the high quality of services provided and customer satisfaction, which has allowed the development of other skills, namely in the areas of Consulting and Human Resources in a Business Process logic. Outsourcing (BPO).

Currently, the UWU has 16 employees at its service, spread across offices in Lisbon, Caldas da Rainha, Rio Maior and Antwerp (Belgium).