May 2019 marked a further drop in the number of new car registrations in Portugal , a trend that has been verified, with rare exceptions, since September 2018, the date of entry into force of the new WLTP rules.

The tables compiled by ACAP show a decrease of 3.9% in sales of passenger cars (compared to the same month of the previous year), while goods vehicles, whose WLTP rules only apply from September, dropped by 0.7 %.

Based on data provided by ARAC members, rent-a-car continues to assert itself as the main responsible for the volume of registrations in Portugal, registering, in May, 9609 light passenger cars (42.3% of sales in the segment) and 515 light goods vehicles (14.9%, idem).

Brand behavior

In general accounting, since the beginning of the year, compared to the same period in 2018, 4798 fewer light units were registered in Portugal , at an average monthly rate of less than 960 vehicles.

Subscribe to our newsletter

Despite having lost some market share, Renault leads the count in both categories (passenger and goods), followed by Peugeot and Citroën.

One of the novelties in this year's charts prepared by ACAP are the numbers from Tesla which, by the end of May, had already registered 711 new registrations, more than Skoda and almost as many as Honda's.

Hyundai is another of the highlighted brands this year, rising to the 13th position in the sales table thanks to an increase of 43.6% in passengers and 38.6% in global, the highest percentage rate among those who enrolled over 1000 cars in the first five months of the year.

mechanical preferences

The first five months of the year accentuated the preference for gasoline engines in passenger cars (almost 20% variation and already over 51% of the market), followed by diesel engines, with 39.2% of registrations and down 29.4% year-on-year.

Highlight for the vertiginous rise of the hybrid and 100% electric models, which already represent, respectively, 5.3% and 3% of the total commercial of passenger cars in the evaluated period.

In passenger versions, the highest growth rate continues to belong to 100% electric vehicles: 95.3% in 2019.

The five most popular models are:

- Nissan Leaf

- Tesla Model 3

- Renault ZOE

- BMW i3

- Hyundai Kauai

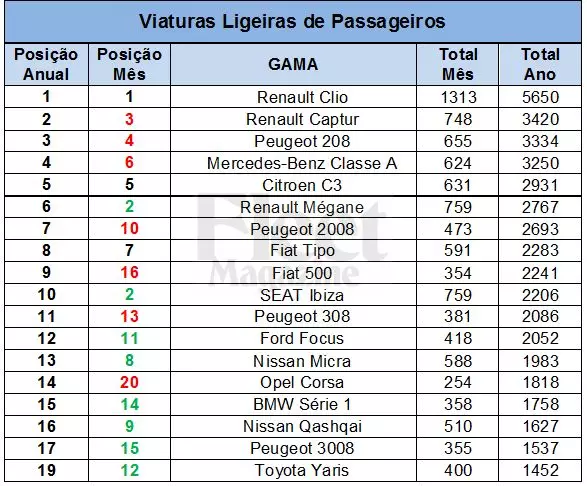

Best selling models table: May 2019/cumulated

By segment, in passenger cars, the dominant segment in 2019 continues to be the SUV with 28.3% of the market, followed by a few dozen units in the Utilities class (28.3%) and, a little further away, there are the Medium Family (26.1%).

However, May registered a slight recovery in the C/Average Families segment (+1.93%), where the largest purchases by companies are concentrated, in contrast to SUVs (-1.7%).

However, the segments that experience the greatest decline continue to be D (Large Families) and E (Luxury), segments that seem to be the most affected by the migration of sales to SUV versions.

In commercials, the top five positions are occupied by Peugeot Partner, Renault Kangoo Express, Citroën Berlingo, Fiat Dobló and Renault Master.

Consult Fleet Magazine for more articles on the automotive market.